There are four basic types of vertical spreads:

Having a sound understanding of vertical spread types and how they differ helps you employ your chosen strategy variation more effectively.

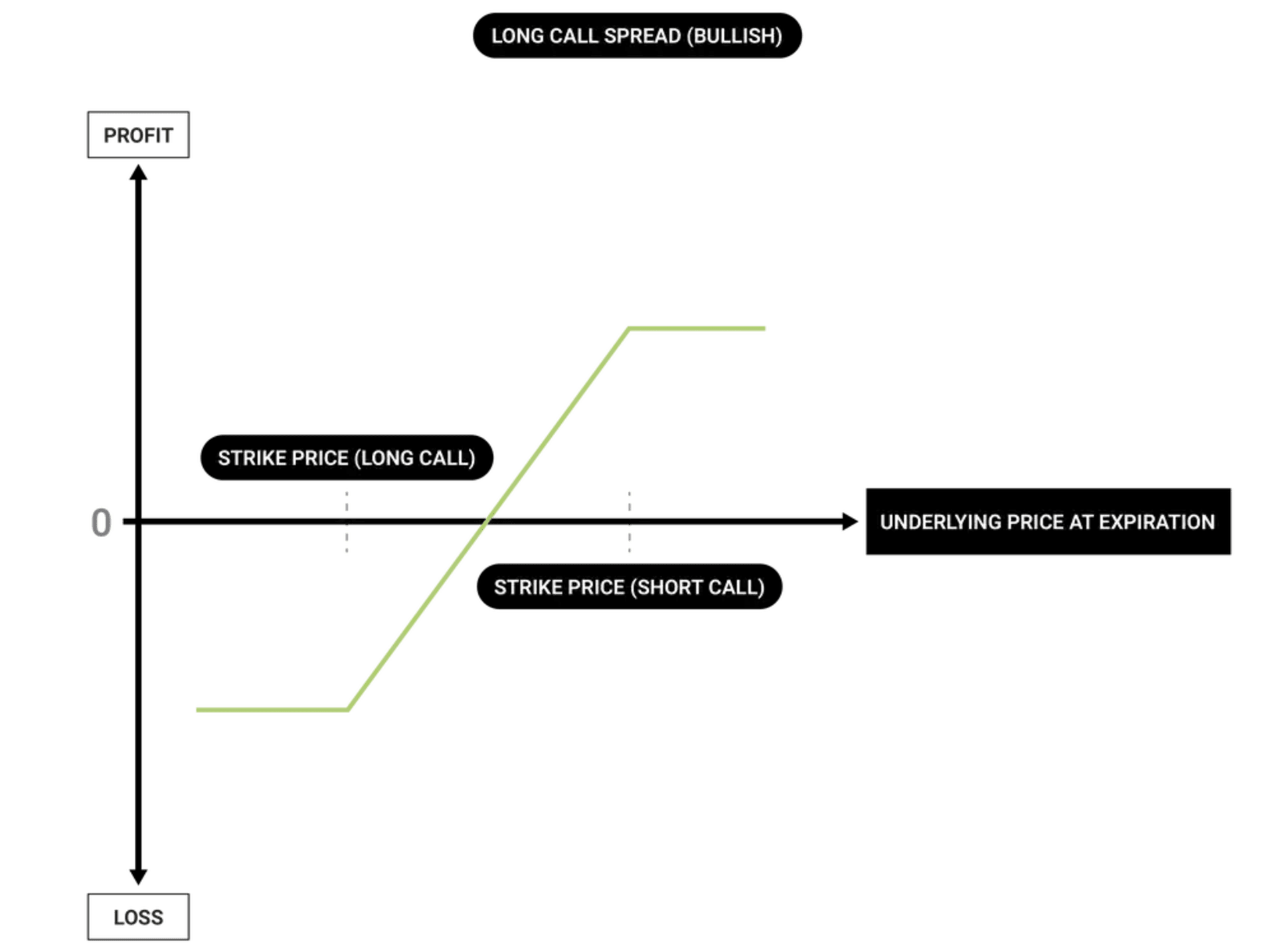

A long call vertical spread is a bullish, defined-risk strategy made up of a long and short call on the same underlying asset within the same expiration cycle, but at different strikes. The short call strike is higher than the long call strike, as it “caps” the profit potential in the long call while reducing the overall risk and cost of the position.

In a long call spread, you’d make the maximum profit if the market price at expiration (or execution of trade) is at or above the short call strike price. In this case, the long call would have appreciated in value as much as it could before reaching the short strike, where profits are capped.

You’d incur the maximum loss, which is the debit paid for the trade upfront, if the underlying price is at or below the long call strike price. In this debit spread, losses are limited to the position’s net cost on entry, while profits are capped at the difference between the strike prices, minus the debit paid upfront.

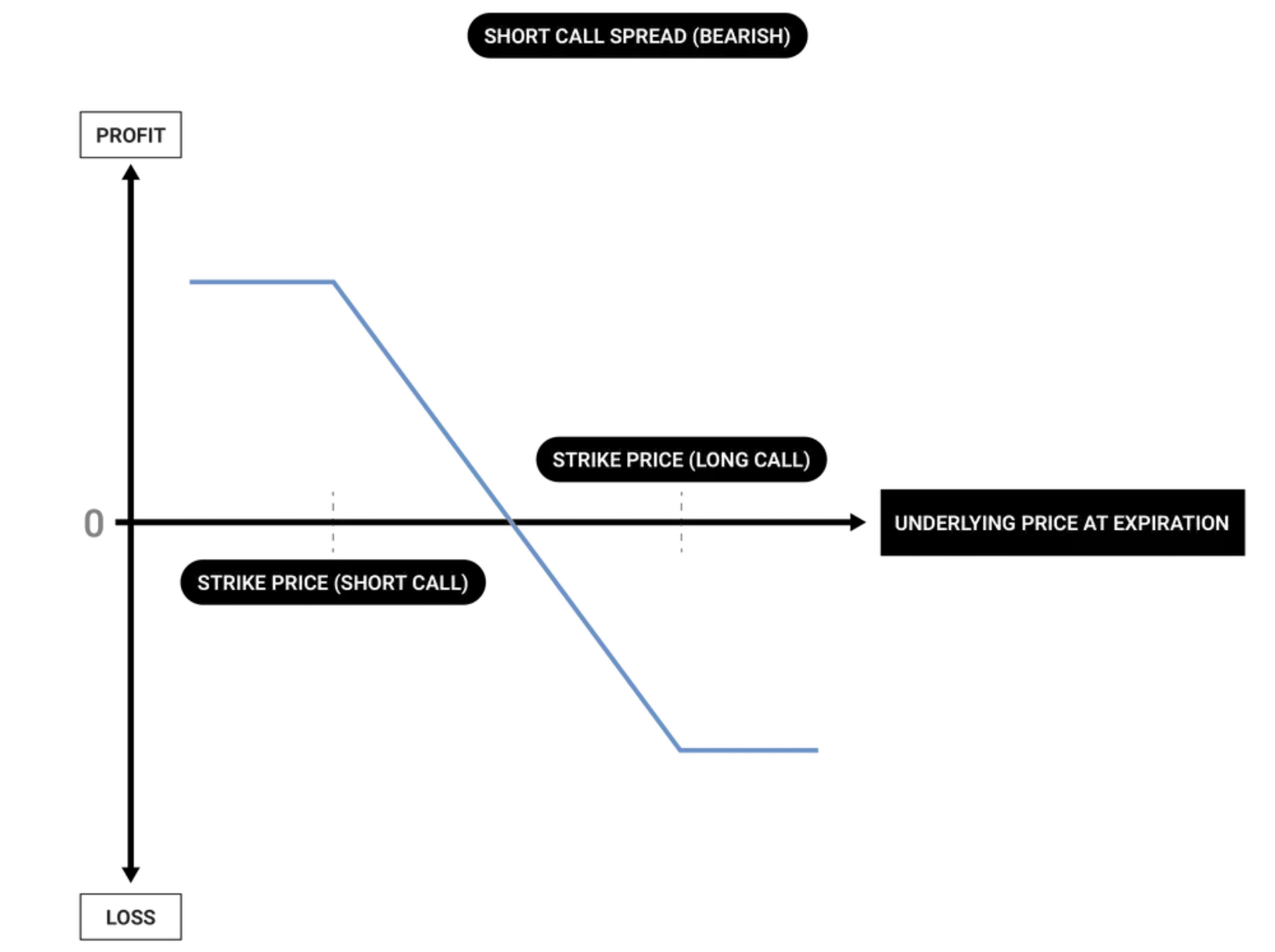

A short call vertical spread is a bearish, defined-risk strategy made up of a short and long call at different strikes within the same expiration period. Both strikes are out of the money (OTM) on setup, but the short strike is closer to the stock price than the long call.

This trade is routed to collect a credit upfront. If the stock price decreases so that the value of the credit spread decreases over time, the initial credit received upfront is kept as profit at execution of the trade.

In a short call spread, maximum profit potential is the credit received upfront, if the position expires worthless and OTM at expiration. This happens when the underlying instrument’s price at expiration (or execution of trade), is equal to or below the short call’s strike price. Conversely, you’d incur the maximum loss if it’s equal to or above the long call’s strike price. In this credit spread, losses are limited to the difference between the call strikes, minus the net premium collected upfront; while profits are capped at the net premium collected upfront.

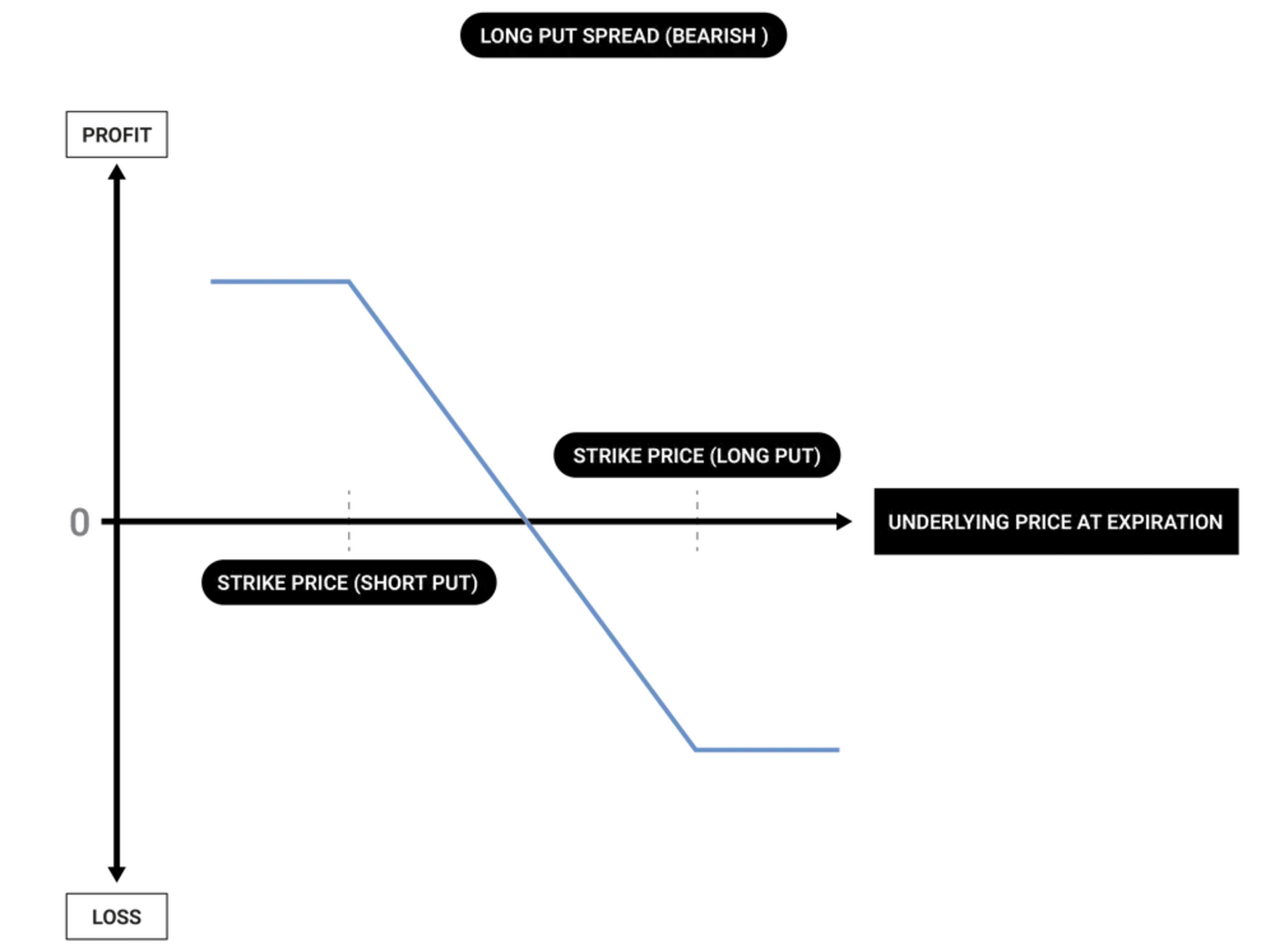

A long put vertical spread is a bearish, defined-risk strategy made up of a short and long put at different strikes in the same expiration cycle. The strike price of the long put is higher than the short put and the value of a long put vertical spread will increase when there’s a drop in the underlying asset’s price.

You’d make the most profit possible if the market price at expiration, or execution of the trade, is at or below the short put’s strike price. However, if it’s equal to or above the long put’s strike price, you’d incur the largest possible loss. In this debit spread, the maximum potential profit is the difference between put strikes, minus the net premium paid upfront; and losses are limited to the net premium value paid upfront.

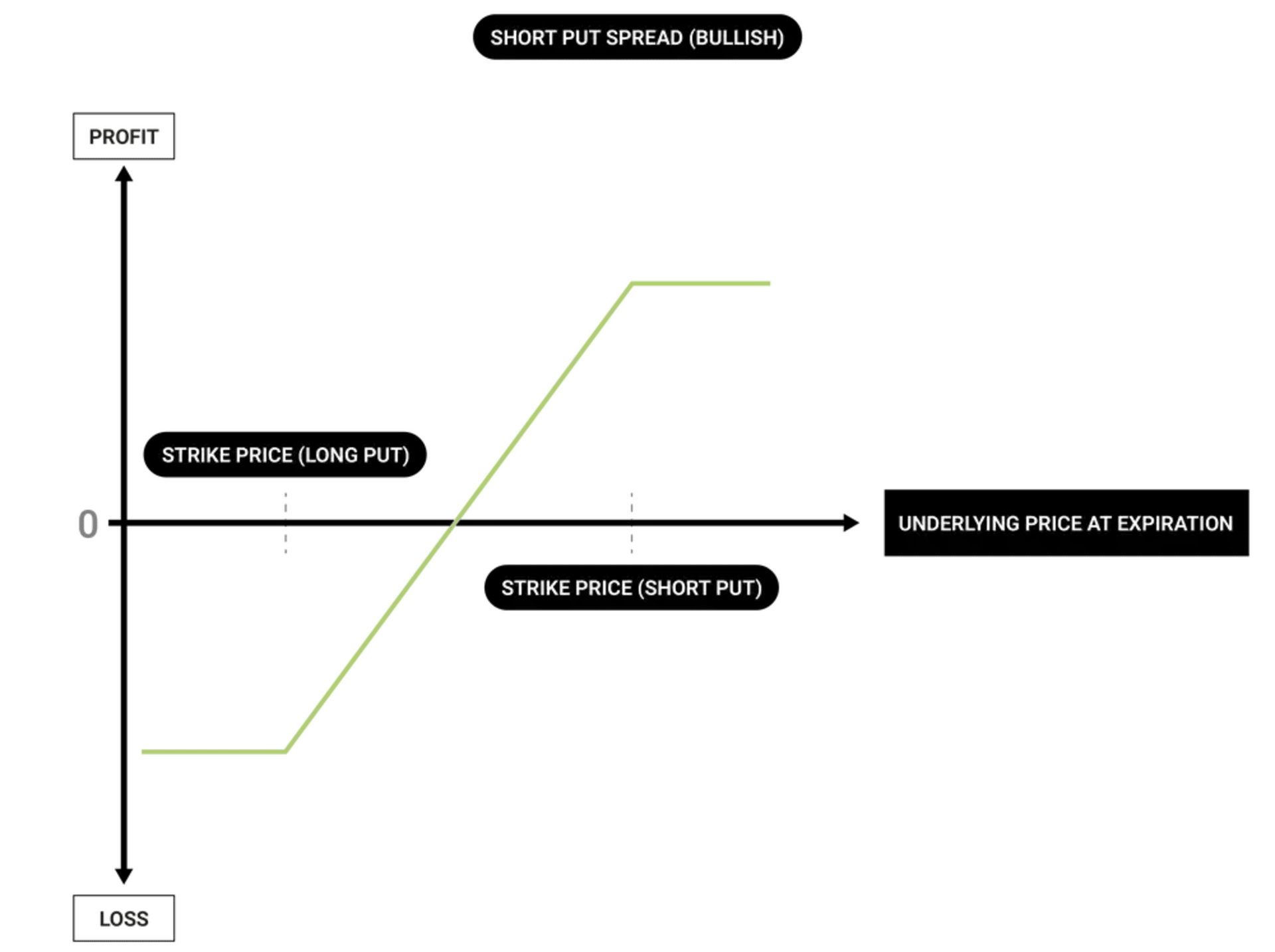

A short put vertical spread is a bullish, defined-risk strategy made up of a long and short put at different strikes in the same expiration. The strike price of the short put is higher than the long put and the value of a short put vertical spread will decrease when there’s a rise in the underlying asset’s price.

You’d make the most profit possible if the market price at expiration (or execution of trade) is at or above the short put’s strike price. But, if it’s equal to or below the long put’s strike price, you’d incur the largest possible loss. In this credit spread, the maximum possible profit is equal to the net premium collected upfront, while losses are limited to the difference between put strikes, minus the net premium collected upfront.