Systematic Theta Strategy with Synthetic Base

Strategy Overview

- Combine synthetic long (buy call + sell put) with short perpetual(Delta-neutral synthetic base)

- Systematically sell weekly options(call/put) for theta income

- Use Perp only when assigned for delivery

- Goal: steady theta income with minimal directional risk

Strategy Architecture

Core Components

| Layer |

Description |

Objective |

| Synthetic Long(1-2 months) |

Long Call + Short Put, same strike + Core short Perp |

Create synthetic long exposure with short perp (delta-neutral base) |

| Weekly Short option |

Sell weekly call or put |

Generate theta income |

| Trading Perp(conditional) |

Open only upon Assignment |

Settle exercised options via delivery |

Each week

- Sell one weekly option(call or put)

- Do not open any new perp unless that option finishes ITM

- If exercised, use perp to delivery (short call -> short perp; short put -> long perp)

Weekly Option Cycle

- Sell weekly call

- If call expires OTM -> Keep premium

- If call ITM -> open trading short perp (delivery)

- Next week, sell weekly put (same strike)

- If put ITM -> open trading long perp -> close short

- Repeat cycle

Example Flow

| Week |

Action |

BTC Close |

Delivery |

Outcome |

| 1 |

Sell 100K Call |

98K |

None |

+premium |

| 2 |

Sell 100K Call |

101K |

Short Perp |

Delivery + premium |

| 3 |

Sell 100K Put |

100K |

Long Perp |

Close short + premium |

Summary

- This strategy combines a synthetic long position with short perpetual futures to create a delta-neutral base, upon which a weekly options grid is systematically sold.

- The structure profits primarily from time decay (theta) and range-bound price action, while dynamically using perpetual contracts for delivery when options expire in-the-money.

- The key innovation is that no active delta hedging is performed — perpetual contracts are used only upon option assignment, making the structure highly capital-efficient and low-maintenance.

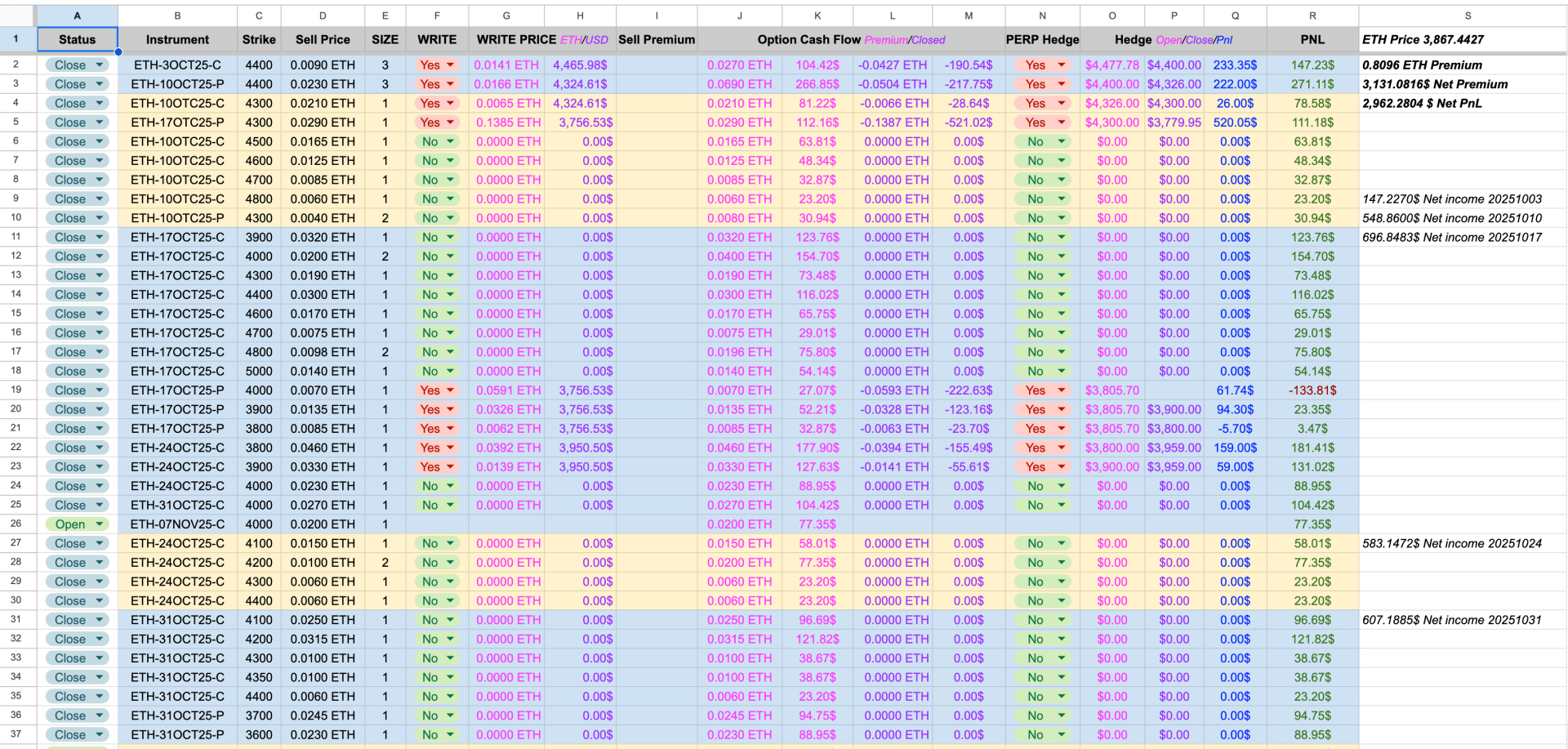

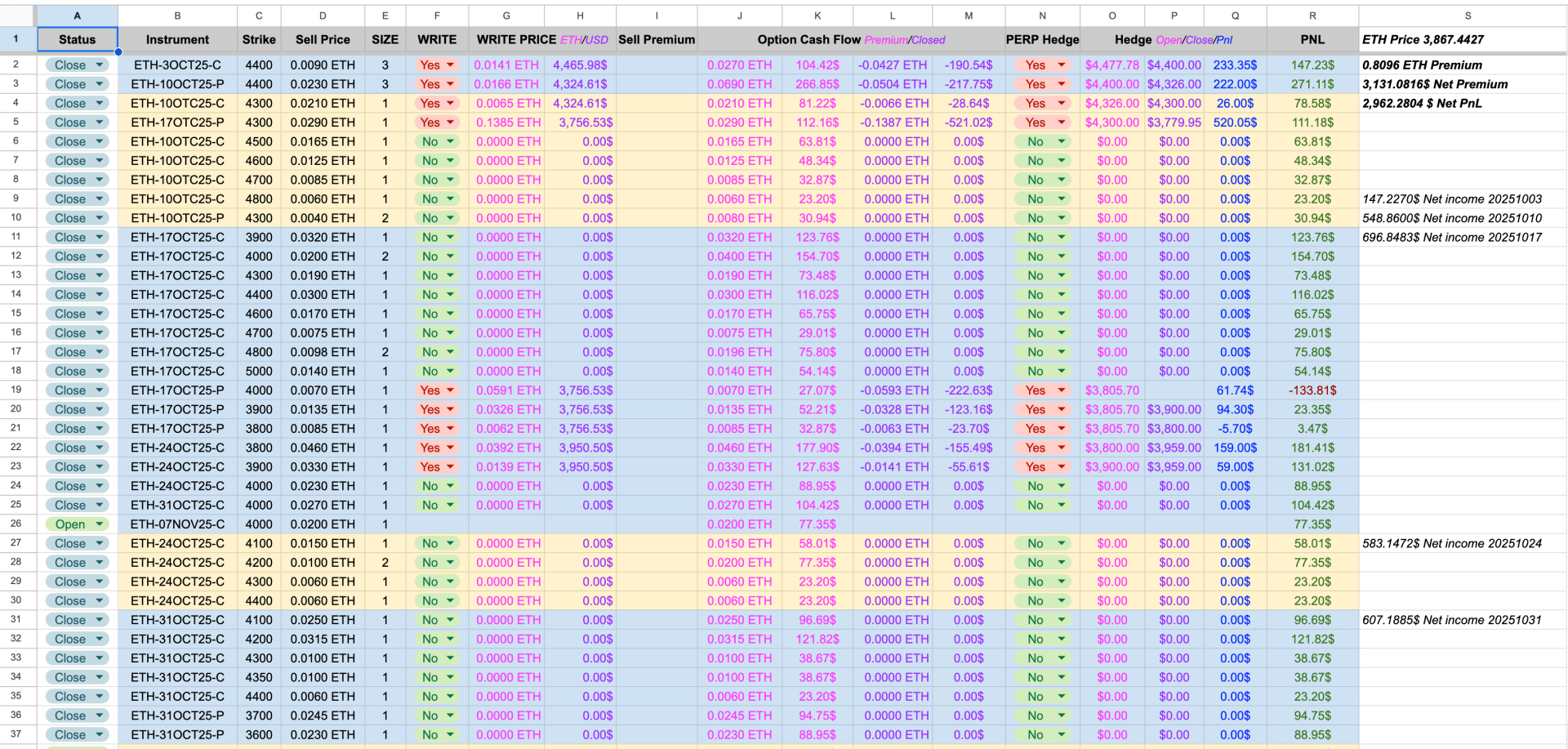

Real trade sample